ADVERTISEMENT

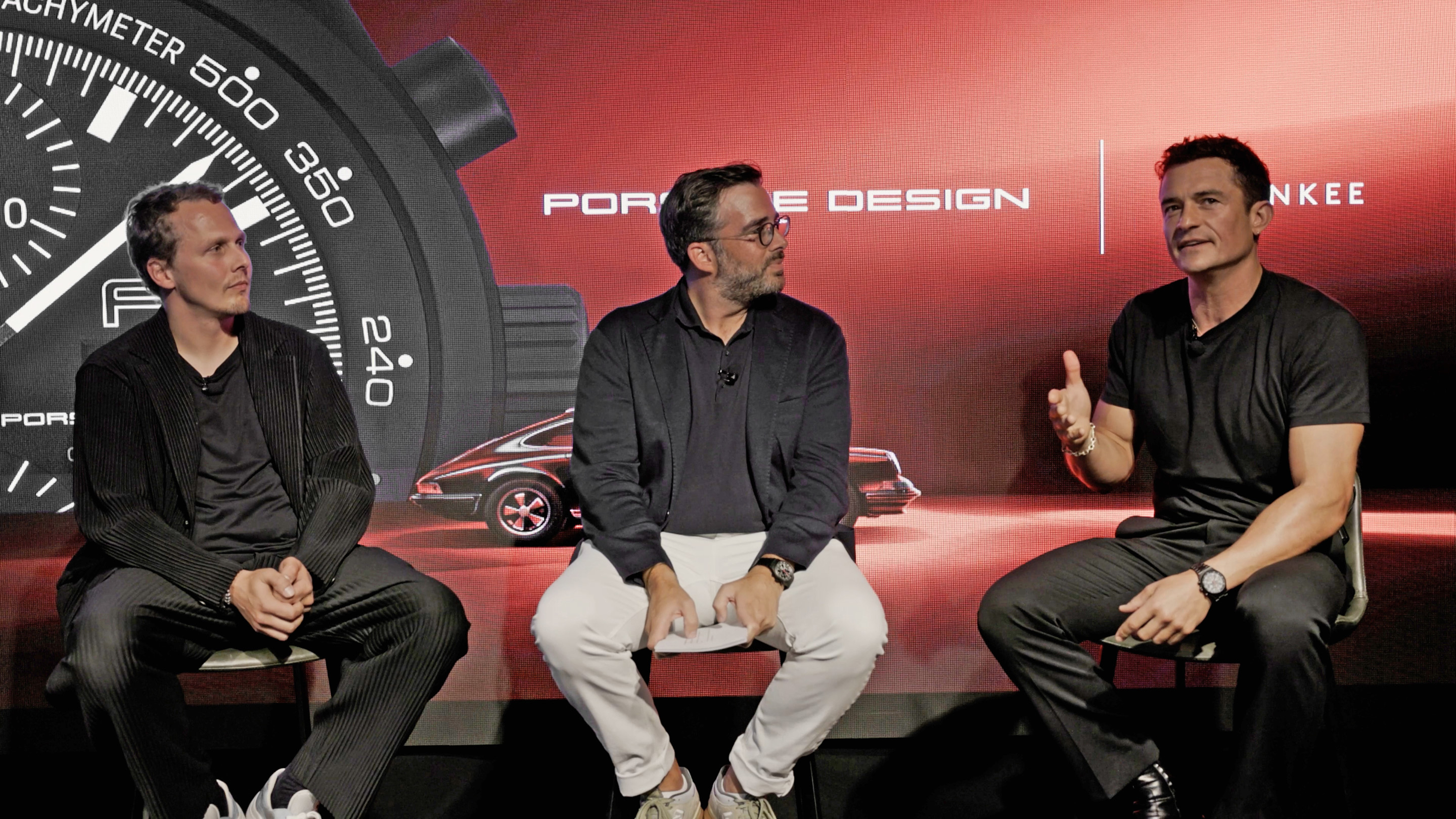

The collecting journey is seldom a linear one. Buying, selling, trading – they're all part of how your collection will take shape and transform over the years. In an ideal world, your own ever-evolving tastes would inform the depth and breadth of your collection, but we all know that collecting is more than that – it's an investment. "Today, watches have really become an asset class that's part of your financial portfolio," confirms Jacek Kozubek, the dealer behind Tropical Watch, one of the leading destinations for vintage and pre-owned timepieces. "Even though it's smart and necessary to view watches in this way," he continues, "it's important to remember it's still about the joy of wearing an object that's meaningful to you."

Yes, this delicate balance is the essence of collecting. There's the heartbeat at the center of it all – the deep passion we share for these objects, their sentiment, their beauty – and there's the practical investment. At the end of the day, some of the best watches and jewelry command five or six-figure price tags, and they should be treated as such when it comes to things like estate planning or insurance (more on this later).

The Big Picture

In the current climate (both within the luxury sector and the broader global economy), value seems to be a moving target thanks to numerous factors, from hype models to imposed tariffs. It can be tough to keep up with the value of your current collection, let alone know when to expand or adjust your collection by buying, selling, or trading. "Of course, you should always keep a pulse on the market and economy," affirms Giovanni Prigigallo, Co-Founder and Head of Business Development at Everywatch, the world's largest watch market database. "However, valuing your collection is more than just looking at the current moment," he continues. "It's understanding the historical performance of a watch through its past sales as well as its current asking price."

Fittingly, Everywatch is a platform designed to help you do just that. With four different tiers of membership, you get varying levels of access to this type of data. "From an investment perspective, it's best to retain and purchase models with a long-term track record as opposed to something that's popular because it's performing well at the moment," offers Prigigallo. Wes Wynne, the dealer behind Collector's Corner NY agrees "As a dealer, I may be biased," he prefaces, "but for me, vintage and even neo vintage – like a Zenith Daytona that's been in the market 20-plus years – is a much safer asset with a more predictable value compared to say one of the new panda Daytonas that's performing well in the market now but doesn't have the history behind it."

Gold: Two Sides of the Coin

Somewhere in between industry-specific factors like hype models and broader global factors like tariffs are other aspects in constant ebb and flow, like the value of gold. "Every morning, I look at the financial markets (including the price of gold and silver) to get an idea of what the appetite might be in the watch market," shares Wynne, "but this is just one of many things to consider."

Prigigallo agrees – even this factor shouldn't be taken strictly at face value. "We can clearly see the price of gold has doubled in the past year and a half, and in turn, gold watches have also risen in price," he explains. "But it's more nuanced than this – take, for instance, a gold Rolex Day Date. For years, these held a value of around $9,000-$10,000, and now, with the price of gold, they are $13,000 to $14,000. Here, the watch is quite literally worth its weight in gold!" Prigigallo laughs. "Then take a Patek Philippe 5711 in gold – the value of this watch has remained relatively stable around $150,000 even with the changing price of gold because the value lies less in the metal and more in the watch itself."

Protecting Your Collection’s Value

You may recall a story I wrote last month on understanding valuation and appraisals when getting your watches and jewelry insured. When the time comes for estate planning or updating your insurance policy, particularly for watches or jewelry with value above $100,000, we (of course) recommend a formal appraisal. However, for watches or jewelry valued under $100,000, tracking the value through tools like Everywatch and trusted dealers is all that's required with Hodinkee Insurance.

With Hodinkee Insurance, you can insure watches up to $100,000 at the value you determine based on tracking the market, and you can adjust and update the value at any time right in the Hodinkee app. Always be sure to click on the appropriate action for each watch, whether adding, removing, or updating values (you can make multiple adjustments on your policy at once). After making the necessary changes for each watch, you can request a new quote to see your updated premium with any prorated balance due if coverage is increased and any prorated refund if coverage is decreased. Keep in mind that coverage is effective as soon as you submit your updated coverage.

As an added layer of protection, if the market value of a watch or jewelry covered on your policy has increased before a loss, we'll pay the market value before the loss – up to 150% of your watch or jewelry's insured value, subject to the policy limit.

Have additional questions about valuations, appraisals, or your collection? We're here to help, just send us an email at [email protected]. If you're ready to start a policy, you can get a quote for your collection in just a few minutes. Click here to learn more and start an application for a free quote.